Free Personal Medicare Plan Comparisons so together we can find the best Plan for your needs

Medicare Advantage Plans, Medicare Supplement Plans and Prescription Drug Plans

Plans from Top Rated National Health Insurance Companies: AARP United HealthCare, Aetna, HealthSpring (formerly Cigna), CarePlus, DentalPlans.com, Freedom Health, Humana, Optimum HealthCare, SilverScript, UnitedAmerican, WellCare

Medicare Health Insurance Brokers’ Services are Free. This includes reviewing all plans in your area, checking your doctors’ network status, the cost of your prescriptions, and the plan’s medical services. Once you decide on a plan, your enrollment application is sent electronically to that insurance company.

Offering health insurance plans since 2006. Licensed in Florida, North Carolina and Ohio.

Her local Service area in Florida includes: Palm Beach County, Broward County, Miami-Dade, the Treasure Coast. It also includes the West Coast and Northern Florida.

Medicare Services are Always Free to Medicare Beneficiaries! Call Renee (561) 704-9302

Schedule an appointment so you can get to know each other. After getting to know you and your needs, she will select a few plans for you to look at. Then she will show you how much your costs will be and answer all your questions. If you would like to enroll, she will easily complete your enrollment electronically on the insurance company’s website.

The types of Medicare Products she offers are:

Medicare Supplement Plans

Medicare Supplement Plans work with Original Medicare. Another name for them is Medigap Plans

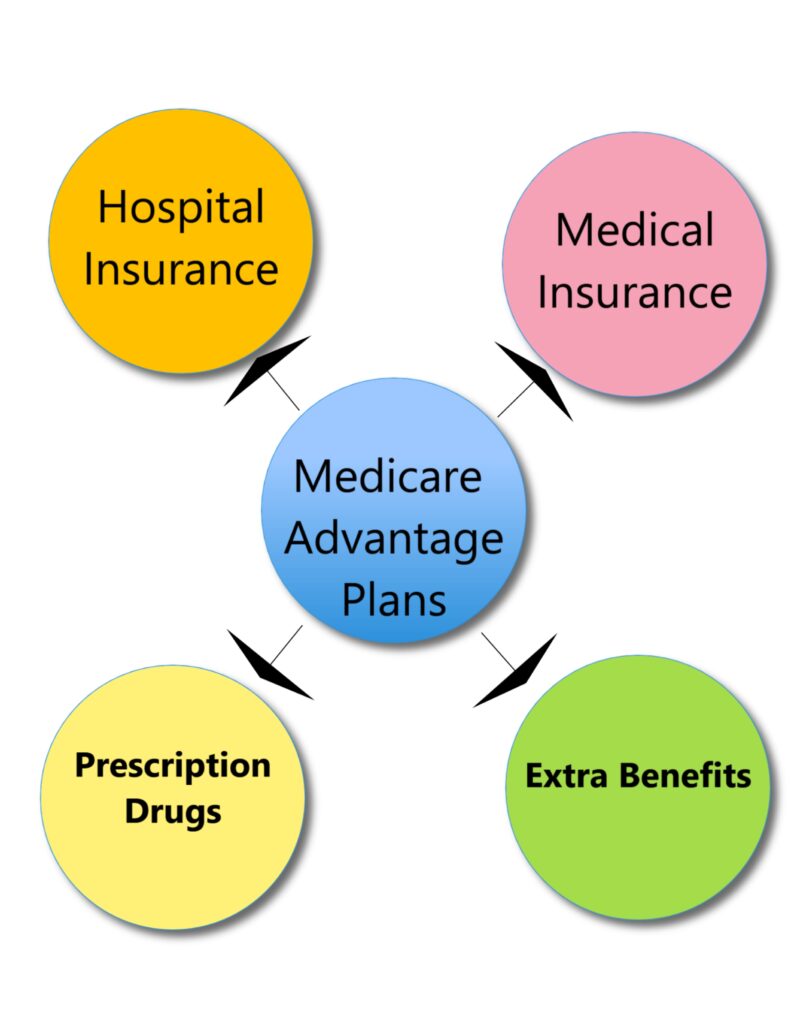

Medicare Advantage Plans

They are also called Medicare Part C or All-In-One Plans. That is because they combine Hospital and Medical Benefits with or without drug coverage.

Prescription Drug Plans

You can receive your drug coverage through a stand alone drug plan, usually with a monthly premium. Another option is Medicare Advantage Plan with Prescription Drug Coverage (MAPD).

As a Medicare Insurance Broker, she helps Medicare Clients in multiple ways:

Explaining why Medicare A and B aren’t enough coverage and what your choices are to improve your coverage.

Helping you learn how Medicare, Medicare Advantage and Medicare Supplemental plans work.

Providing great customer Service all year round. Free plan reviews and enrollments now and every year after and during AEP.

Finding the Right Plan for you by:

Checking your Drugs and Pharmacy

Discussing your budget for medical expenses

Reviewing your list of doctors and hospitals

Looking at all Medicare PPOs and HMOs

What Clients are saying about Medicare Health Insurance Broker in Florida, North Carolina and Ohio

Dental Savings and Dental Insurance

Original Medicare doesn’t usually pay for dental services

Medicare Advantage plans offer some dental coverage but it’s not complete.