Medicare Insurance Broker will find the Best Medicare Supplement Plans for your needs

Licensed in and offering plans in Florida, North Carolina and Ohio.

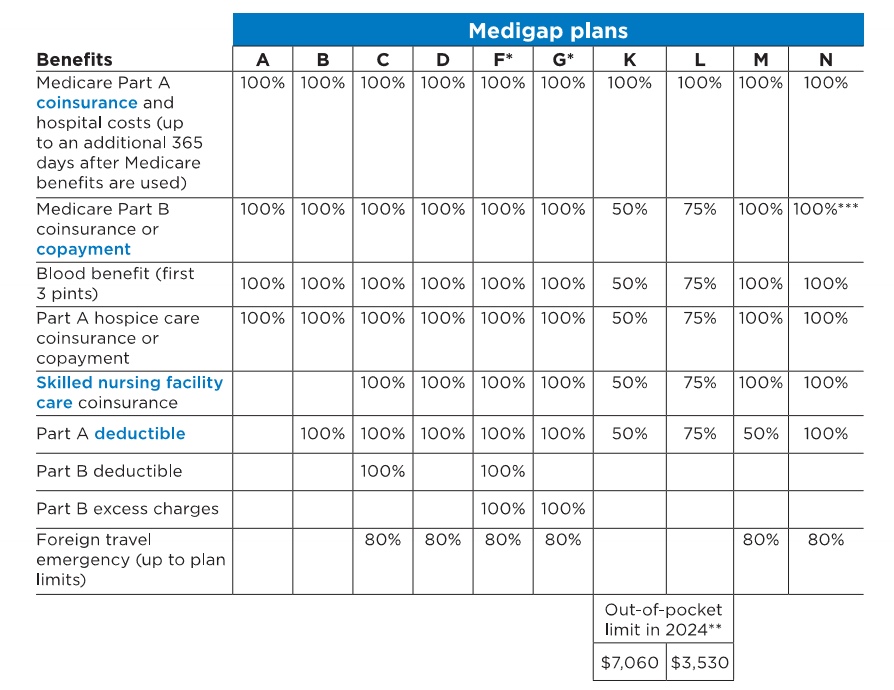

Medicare Supplement Plans, are also known as Medigap plans. They fill some or all of the “gaps” in Original Medicare A and B. These “gaps” include deductibles, coinsurance and in some plans, emergency Medical coverage outside of the United States when you travel. How much each plan covers, depends on which plan you enroll in.

Click Here for your Free Medicare Supplement Rate Comparison from Medicare Health Insurance

How does a Medicare Supplement Plan in Florida Work?

- The Best Medicare Supplement Plans recommended by Medicare Insurance Broker are also known as Medigap Plans

- They work with Original Medicare A (Hospital) and B (Medical) insurance.

- The plans cover gaps in Medicare coverage, such as deductibles, copays and coinsurance.

- As long as Medicare covers a service or product, Medicare pays it’s share.

- There are 10 Standardized plans, which are labeled by a letter. Each plan varys in it’s coverage and monthly premium.

- Unlike Medicare Advantage plans, there are no networks of providers. You can use any Medicare provider in the United States.

- Some of the plans cover Emergency Care outside of the United States. That is not covered by Original Medicare A and B.

- The plans don’t include drug coverage. In order to get drug coverage, you need to enroll in a stand-alone drug plan, with a separate monthly premium

- The plans have a monthly premium, which varies by plan type, your age, where you live, and if you smoke.

You can not be enrolled in a Medicare Supplement Plan and a Medicare Advantage Plan at the same time. Also, it is illegal to sell a Medicare Beneficiary a Medicare Supplement Plan if they are already enrolled in a Medicare Advantage Plan.

Best Medicare Supplement Plans.

Sold on or after January 1, 2020. A,B,C,D,F,HDF,G,HDG and N.

Plans C and F are only be available to beneficiaries with a Medicare Effective Date before January 1, 2020

Why a Medicare Supplement Plan may be best for you:

- Original Medicare only covers about 80% of your Part B medical costs. The other 20% have no annual limit. As a result there is no cap to what you might pay.

- Medicare Supplement Plans allow you to see any provider in the U.S. who accepts Medicare. There are no networks.

- You won’t need a referral from your Primary Care doctor to see a Specialist.

- In addition, if Medicare covers your treatment, you plan will pay what Medicare doesn’t cover. No pre-authorizations are required.

- The plans are Guaranteed Renewable as long as you pay your monthly premium.

When is the best time to enroll in a Medicare Supplement Plan?

The best time to enroll in a Medicare Supplement Plan is during the Medicare Supplement Open Enrollment Period

That is because during this period you will not have to answer Medical Underwriting questions and your acceptance is guaranteed.

Unlike Medicare Advantage Plans, Medicare Supplement Plans don’t have to accept all Medicarea Beneficiaries that apply, outside of a Special Enrollment Period.

When Does the Medicare Open Enrollment Period Begin?

- The Medicare Supplement Open Enrollment Period begins the month you have Medicare Part B and are 65 or older, and last for 6 months.

- There are 10 Standardized Plans, defined by a letter, offering identical coverage regardless of which company sells that plan. Therefore, Plan G from each company has the same benefits. However, the rates will vary greatly.

- You will need to pay a monthly premium for a Medicare Supplement Plan. The plans usually have annual rate increases.

- I will find the plan with the lowest monthly cost for you. That is because I compare rates between companies based on initial rates, history of rate increases, and financial strength.

Medicare Supplement Plans Standardized Benefit Chart. In 2025, the Out of Pocket Limit for Plan L is $3,610 and for Plan K is $7,220. In 2026, it will be $4,000 for Plan L and $8,000 for Plan K.

Medicare-covered costs (coinsurance, copayments, and deductibles) up to the

deductible amount of $2,800 in 2024 before your policy pays anything. (You can’t buy

Plans C and F if you were new to Medicare on or after January 1, 2020. Go to page 75.)

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly

Part B deductible ($257 in 2025), the Medigap plan pays 100% of covered services for

the rest of the calendar year.

***Plan N pays 100% of the Part B coinsurance. You must pay a copayment of up to $20

for some office visits and up to a $20 copy

for some office visits and up to a $50 copayment for emergency room visits that don’t

result in an inpatient admission.

Florida Medicare Insurance Broker works with well-known highly rated insurance companies that offer Medicare Supplement Plans. Renee Lempert will find the lowest cost plan with the most benefits for your needs.

These include: AARP United HealthCare, Aetna, Humana and United American.

Do you have questions or would you like to enroll in a Medicare Plan.