Renee Lempert Medicare Agent at Florida Seniors Health Insurance

Hi I am Renee Lempert Medicare Agent. I help my clients understand Medicare. As a result, they will understand their health and drug plan options. In addition, I work hard to find and enroll my clients in the right plans for their needs.

About Florida Seniors Health Insurance Agent Renee Lempert

Renee Lempert:

- Renee Lempert at Florida Seniors Health Insurance has been a Florida Licensed, Medicare Insurance Agent since 2006.

- In 2012, Renee Lempert became licensed with multiple insurance companies to sell their Medicare Plans.

- Currently, she represents multiple well-known National Insurance Companies.

- She is licensed to sell Medicare Supplement (Medigap) plans, Medicare Advantage Plans, Part D Prescription Drug Plans, Dental and Vision Plans.

- Also, Renee Lempert volunteered for Florida’s SHINE Program (Serving the Health Insurance Needs of the Elderly) between 2011-2012. During my time there she helped educate Medicare beneficiaries about their Medicare insurance options.

- She also assisted clients with applying for financial aid programs such as Extra Help and Medicaid. In 2012, I left my volunteer job to work with the insurance companies offering Medicare plans.

- Since leaving the SHINE program, she has referred many of her clients to their services.

How I Help You, My Medicare Client:

Renee Lempert, Florida Seniors Heath Insurance Medicare Agent can help you find the best coverage for your needs.

Finding the right Medicare Plan is difficult. If all of this sounds confusing and overwhelming, it can be. That’s why you should work with a highly trained and experienced professional Medicare Broker like me. I am an independent Health Insurance Agent who specializes in all types of Medicare plans. These include Medicare Supplement Plans. The best part for you, is my services are completely Free and once I become your agent, I will help you then and in the future!

The entire focus of Florida Seniors Health Insurance’s business is to help you, a Medicare beneficiary. As a result, I work hard to find the right Medicare Advantage or Medicare Supplement plan for you. In addition, my services are entirely free to you. That is because the insurance companies pay me a commission if you enroll in a plan.

Also, since Renee Lempert is an independent Medicare Agent, she doesn’t work for any insurance company. Therefore, my interests are aligned with yours. Even better, if you enroll in a plan and find it doesn’t work for you, we can change it. Just call me and we’ll look at your options.

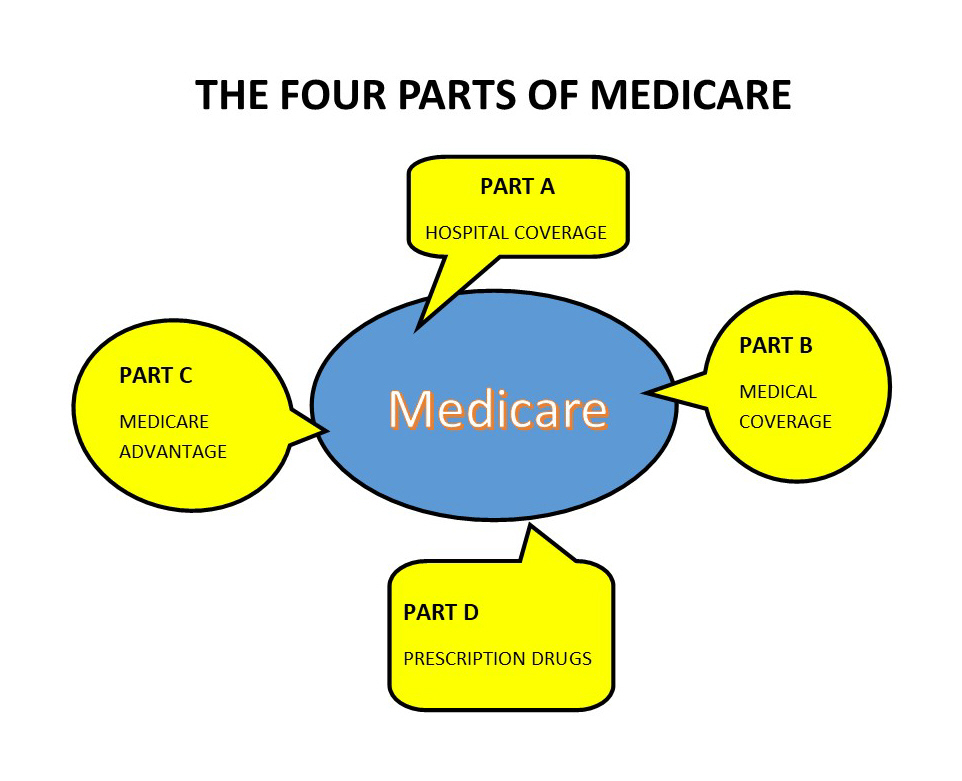

The 4 Parts of Medicare, Explained

Renee Lempert, Licensed health insurance agent, of Florida Seniors Health Insurance will help you Understand How Medicare A, B, C and D Work. That includes making sure you are eligible to enroll in Medicare. you have already been enrolled. If you are collecting Social Security, they will enroll you in Medicare A and B. On the other hand, you may have enrolled yourself online or at a local Social Security office. Here is how to Sign up for Medicare A and B.

Getting to Know Your Medical and Prescription Drug Needs

After a thorough Analysis of your Needs, Renee Lempert, Medicare Agent will review the local plans. Then, she will complete a worry-free ennrollment for you.

There are multiple stand alone Medicare Part D, drug plans in your are. You may also want to get your drug coverage through a Medicare Advantage Plan with prescription drug coverage. Both of these types of plans are offered by well-known insurance companies. Medicare Agent Renee Lempert will find the plan with the lowest cost for your medications.

Your supplemental choices are either Original Medicare with or without a Supplement (Medigap) and with or without a separate drug plan, or an all-in-one Medicare Advantage Plan.(Medicare Part C). These are usually an HMO or PPO.

This is what you Need to Do to Enroll in Medicare Part A and/or Medicare B:

- If you want to receive Medical Insurance (Part B) through Medicare, you’ll need to enroll in Medicare Part B

- However, you can’t enroll in Medicare Part D. Once you receive your Medicare card, you can enroll in a Medicare Drug Plan.

- You can choice to enroll in: either a stand-alone drug plan or a Medicare Advantage plan with drug coverage included. (MAPD)

- Since Medicare A and B have gaps in their coverage, you should enroll in a separate plan to supplement them.

How Medicare Part D, Drug Coverage Works:

- Your annual costs include: a monthly premium, an annual deductible, copays or coinsurance for your medications.

- Every drug plan, has the same 4 Stage of Drug Coverage. These include the annual deductible, initial coverage, coverage gap and catastrophic coverage.

- In 2023, the annual deductible is $505.00 Whether or not you are liable for the deductible, and how much of it, depends on the plan you enroll in.

- After the annual deductible stage, you will enter the initial coverage stage.

- During this time, you will pay a set copay for your medication or a percent called coinsurance.

- Medications covered by the plan are detailed in their Formulary or Drug list.

- Each drug in the plan’s Formulary is assigned a tier which determines its costs.

- It’s important that you learn the plan’s rules. That may save you money on your drug costs.

Why You Should Supplement your Medicare A and B Coverage:

- You will likely need to add drug coverage unless you receive it from another source such as the Veteran’s Administration.

- Also, there is no annual limit to what your Medical and Hospital costs may be.

- You have 2 ways to improve your Original Medicare coverage: The 1st way is you can add a Medicare Supplement plan. It is also known as Medigap and a separate drug plan. The 2nd way is you can enroll in a Medicare Advantage plan with or without prescription drug coverage.

How to Save Money on your Medicare Costs

- Each year, drug plan costs changes, based on Medicare’s rule. You should review your drug plan each year to see if its still the best plan for you. That way, you can save money.

- It’s also important to read and understand the plans’ rules. As an example, these include sucpreauthorization and quantity limits.

- If you don’t enroll in Medicare Part D when you are first eligible, you will incur a permanent penalty. As a result, your monthly premium will be higher if you do enroll in the future.

- There are dozens of plans in your area, with varying costs and benefits. It’s easy to save a great deal of money if you review and compare your plan to others. You can do this by working with a Medicare Insurance broker to compare plans.

Important Points You Need To Know:

Each year, the Medicare Advantage and drug plans may change their coverage and costs.

If you are enrolled in a Medicare Advantage Plan, the insurance company who manages your plan will send you a document around the end of September.

It’s called the Annual Notice of Change (ANOC) and it will compare the plan’s benefits and costs for 2023 and 2024.

It’s important to review your plan during the Annual Enrollment Period with your Medicare Insurance Broker.

Florida Seniors Health Insurance will help you and there is never a fee for my services!

Read this article in Fortune.com about why you should use an Independent Insurance Broker.

Do you have questions or would you like to enroll in a plan?